Mergers And Acquisitions Process

Acquisition fees are another name for the costs and commissions incurred during the purchase or acquisition of real estate. It is important to distinguish between a loan acquisition fee and an acquisition cost, which is the entire cost that a business records for property or equipment on its books after adjusting for discounts, incentives, and.

BMW 1 SERIES 2.0 120D SPORT 2DR 175 BHP YouTube

An acquisition fee is a fee that is charged by the leasing company for originating the lease, reports Cars.com. More specifically, the acquisition fee is charged to the lessee in order to cover the lender's administration duties in drafting up - or creating - the lease. These duties include pulling your credit report and verifying your.

Revised Fee Structure for the Industry Sand & Stone

The acquisition fee is what the lessor will charge you to set up your lease. It's intended to compensate the lessor for taking the time to verify your credit and insurance before extending the.

Island and lagoon lease acquisition fees announced for 2016 Hotelier Maldives

An acquisition fee is a fee you pay when leasing a car or other types of vehicles. It may also be referred to as the assignment, administrative, or origination fee.

What are Syndication Fees Acquisition Fee Asset Management Fee YouTube

An acquisition fee is a fee you pay when leasing a car or other types of vehicles. It may also be referred to as the assignment, administrative, or origination fee. The fee is generally a few.

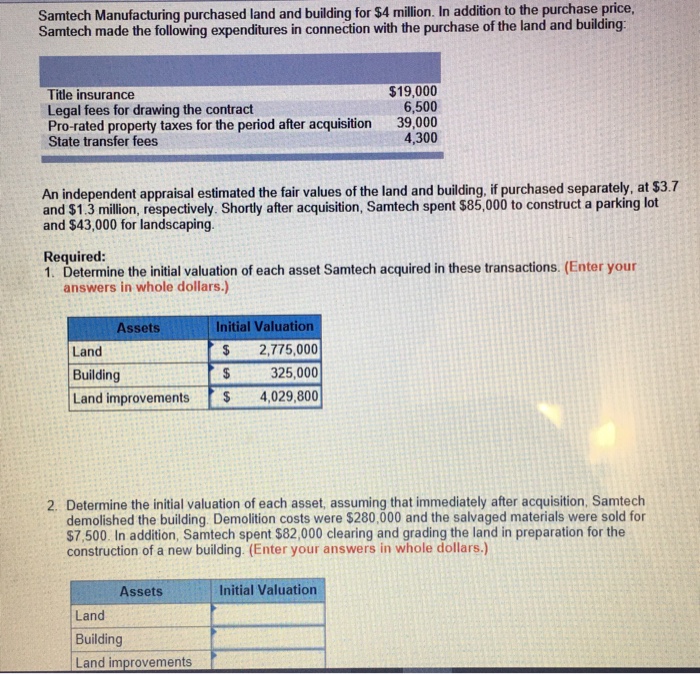

Samtech Manufacturing Purchased Land And Building

An "acquisition fee" is a fee charged by an automotive leasing company for originating a lease. Sometimes called a bank fee or origination fee, it's charged to cover the financial.

Usa, the authorities reject the acquisition of Activision Blizzard by Microsoftbreakinglatest

A car acquisition fee is a fee that's charged by the organization leasing the vehicle to cover the administrative costs of setting up the lease. These costs can include the pulling and reviewing of credit reports, the verification of car insurance, the creation and signing of paperwork, and so forth. It's important to remember that this fee.

Understand Acquisition Fees in Multifamily Syndications YouTube

An acquisition fee is a fee you pay when leasing a car or other types of vehicles. It may also be referred to as the assignment, administrative, or origination fee.

Real Estate Acquisition Fees Explained Mortar Group

An acquisition fee is a leasing charge or fee that covers the administrative cost of the seller or lessor in arranging the lease. The cost typically covers expenses such as obtaining the buyer or lessee's credit reports, reviewing the lease documentation, and verifying the insurance policy. When you take out a loan, you must usually pay the.

Solved The acquisition of a used machine with a purchase

In most cases, the leasing company makes the Acquisition Fee available to the dealer with a markup. So, if it is a $795 fee mentioned in the leasing contract, it only represents $395 of the cost applied from the bank. The remaining $400 is applied by the dealer as profit. A dealer will always prefer not to discuss the Acquisition Fee at all.

Acquisition Free Creative Commons Handwriting image

A real estate acquisition fee covers the various costs associated with closing on an investment property. The fee is paid from a buyer to a lender and can include expenses like underwriting, agent commissions, and construction charges. Anyone involved in property investment — buyer or seller — has a vested interest in real estate.

What is an Acquisition Fee in Real Estate? QC Capital

Acquisition Fee: A fee charged by a lessor to cover the expenses incurred in arranging a lease. Acquisition fees may also refer to charges and commissions paid for the acquisition or purchase of.

Post Merger Integration Plan Template

An acquisition fee is a charge levied by a lessor or lender to offset the administrative expenses involved in setting up a lease or loan. These expenses can include various costs related to the transaction.

Acquisition Fees in Commercial Real Estate Explained FNRP

For deals valued at $5 million and $10 million, the most common fee is between 4% and 5.9%. For $20 million and $50 million deals, fees are most likely between 2% and 3.9%. And for deals of $100 million and $150 million, the most common fee range is 1% to 1.9%. In every deal size, however, the average fee inched up compared to a year ago.

Acquisition Free of Charge Creative Commons Tablet Dictionary image

Acquisition fees vary among lease companies and are usually higher for more expensive vehicles. Generally, acquisition fees range from about $395 to $1095, with an average of about $595. The fee is typically not negotiable since it is set by the lease company and dealers do not have control of it. In many leases, the fee is simply added to.

10 Best Customer Acquisition Tools

An acquisition fee is a cost imposed as part of obtaining a real estate property, typically in the acquisition of commercial real estate ventures. It serves several essential purposes for the involved parties. One of its primary roles is compensation — it reimburses the party that facilitated the property's transition.