New Clean Vehicle Tax Credit Plan Means Most EVs No Longer Qualify Forbes Wheels

/https://www.forbes.com/wheels/wp-content/uploads/2022/08/New-EV-Tax-Credit-Program_Main.png)

ATLANTA - Georgia lawmakers gave final approval Monday to a bill to charge taxes on electricity for charging electric vehicle s. Currently, the state uses taxes levied on gasoline to pay for.

How The EV Tax Credit Can Benefit You EVAmerica

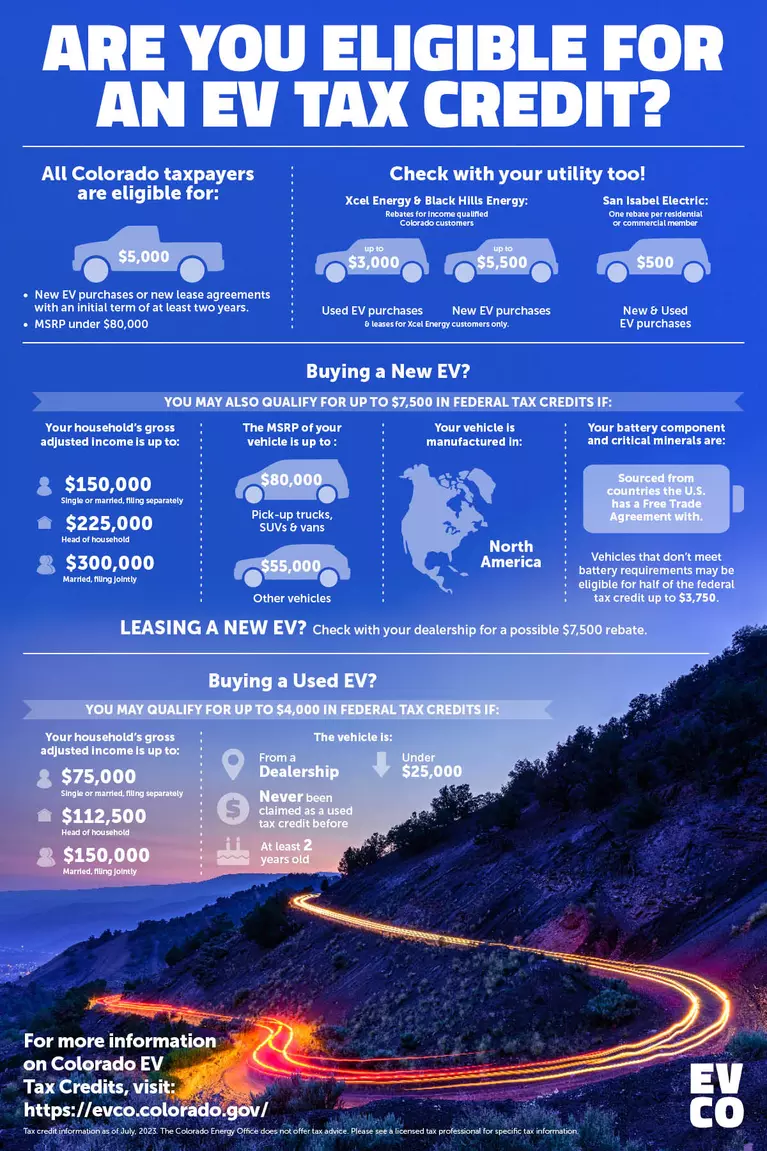

If you place in service a new plug-in electric vehicle (EV) or fuel cell vehicle (FCV) in 2023 or after, you may qualify for a clean vehicle tax credit. At the time of sale, a seller must give you information about your vehicle's qualifications. Sellers must also register online and report the same information to the IRS.

EV Tax Credit 2023 New Rule Changes and What's Ahead Kiplinger

Shop for Chargers Additional rebates Currently there are no Georgia state tax incentives for the purchase of an Electric Vehicle. However, there are various federal tax incentives available. Check out the specifics here. Federal EV Tax Credit Benefits of driving electric

EV Tax Credit Calculator Forbes Wheels

2. Electric Vehicle (EV) Charging Station Tax Credit. A qualifying business entity is eligible for an income tax credit when purchasing, leasing, and installing an approved EV charging station in Georgia. The Georgia EV tax credit amounts to 10% of the station's cost, with a maximum credit capped at $2,500.

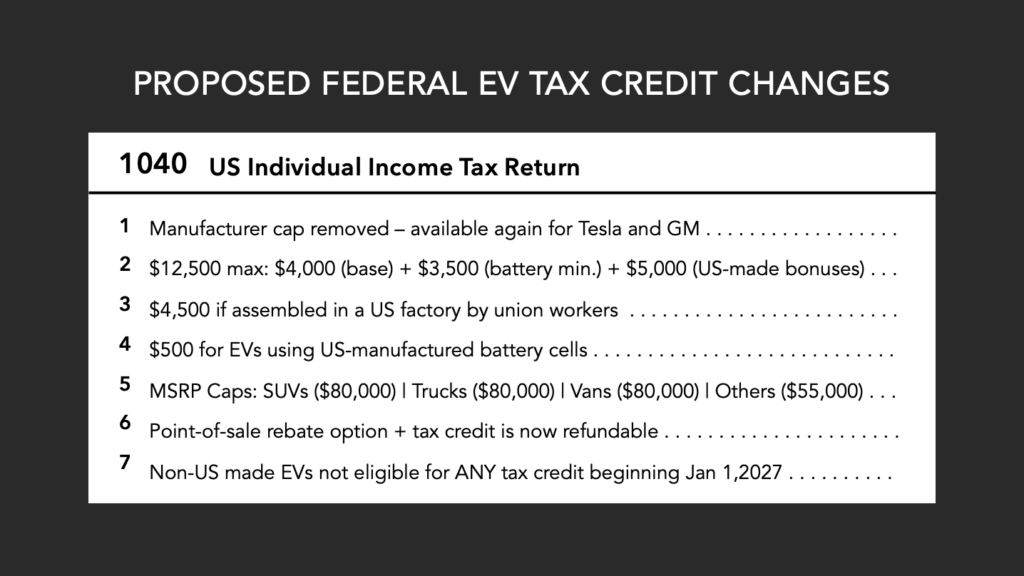

EV tax credit changes mean buyers can soon get full 7,500 Electrek

Yes, Georgia charges non-commercial electric car owners an annual licensing fee of $210.87 in addition to the annual $20 registration charge all vehicle owners must pay. Furthermore, vehicles.

The New EV Tax Credit in 2023 Everything You Need To Know (Updated) CarEdge

What is the electric vehicle tax credit? Which cars qualify for a federal EV tax credit? How to qualify for the 2024 EV tax credit How the electric vehicle tax credit is calculated.

The Complete List Of Cars Eligible For The 7,500 EV And PHEV Federal Tax Credit

An equipment-centric EV tax credit in Georgia, the policy provides a 10% credit up to $2500 to any business entity that installs EVSE equipment in Georgia. Electric charger Rebate When you install a level 2 EV charger, you are eligible for redeeming cash rebates up to $250 (residential) and $500 (business) from the Georgia Power Corporation .

Cars assembled outside NA may qualify for EV tax credit, per new IRS note Electrek

The Georgia Electric Vehicle Tax Credit is a state-provided incentive designed to encourage the adoption of electric vehicles by offering financial benefits to purchasers or lessees of new EVs. This initiative not only aims to reduce greenhouse gas emissions but also to foster a sustainable transportation ecosystem within the state.

What Cars Are Eligible for the 7500 EV Tax Credit? It’s Complicated

All electric and plug-in hybrid cars purchased in or after 2010 may be eligible for a federal income tax credit of up to $7,500. The credit amount will vary based on the capacity of the battery used to power the vehicle. Visit FuelEconomy.gov for more information. Featured Rebate EV Charger Installation Rebate Up to $150

US Government Could have saved around 2B Giving EV Buyers Cash Instead of Tax Credit, According

New federal legislation called The Inflation Reduction Act (IRA) includes tax credits that can lower the cost for most Georgians in the market for either a new or used electric vehicle. Tax Credits for New Electric Vehicles The new Clean Vehicle Credits from the IRA officially kick in on January 1, 2023.

Are You Eligible for an EV Tax Credit? EV CO

Georgia Power customers can get a $250 rebate for home EV charging installed in 2023. Georgia Power also offers a "Plug-in Vehicle Rate" that lowers the cost of charging overnight for its customers. Visit our EV community on Facebook to connect with other electric vehicle owners in your area and find out if specific offers are available.

Illinois EV Tax Credit score Defined 2023 Electric Revolution The Latest News and

Georgia Georgia electric vehicle rebates, tax credits and other incentives As of January 1st, 2024, buyers are able to transfer the federal EV tax credit to a qualified dealer at the.

EV Tax Credit Explained What You Need to Know YouTube

Electric Vehicles. Tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. You can claim the credit yourself or work with your dealership. Make sure you meet the requirements below.

Updates on EV Tax Credit PriorTax Blog

Although there's no dedicated EV tax credit in 2023 for Georgia residents, EV drivers may be eligible for federal tax credits and charging credits. You may qualify for Electrify America charging credits by purchasing one of the following BMW electric vehicles: 2022/2023 BMW iX and i4: Free 30-minute DC Fast Charging sessions for a period of.

Proposed Federal EV Tax Credit Changes IRC 30Dfeatured imagev3 EVAdoption

All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal tax credit of up to $7,500. So, when you buy a new Ford Mustang Mach-E or other EV from our nearby Ford dealer, you can claim a federal tax credit. You can browse our list below to see which vehicles specifically qualify for federal tax credits.

Everything you need to know about the IRS's new EV tax credit guidance Our Health Needs

Below you'll find the current Electric Vehicle tax credit opportunities available in Georgia. Currently, the only one available is for a Level 2 home charger but check back often to see if any have been added. Georgia Power offers residential customers a $250 rebate for Level 2 EV chargers installed between January 1, 2020, and December 31, 2022.