Buying Versus Leasing a Car

You can use this car lease calculator to figure out your monthly lease payment for lease terms of 24, 36, and 48 months. The calculator provides the user with a variety of information, including sales taxes due on signing, total of all payments, and the total monthly lease payment. Moneyzine Editor. June 8th, 2022.

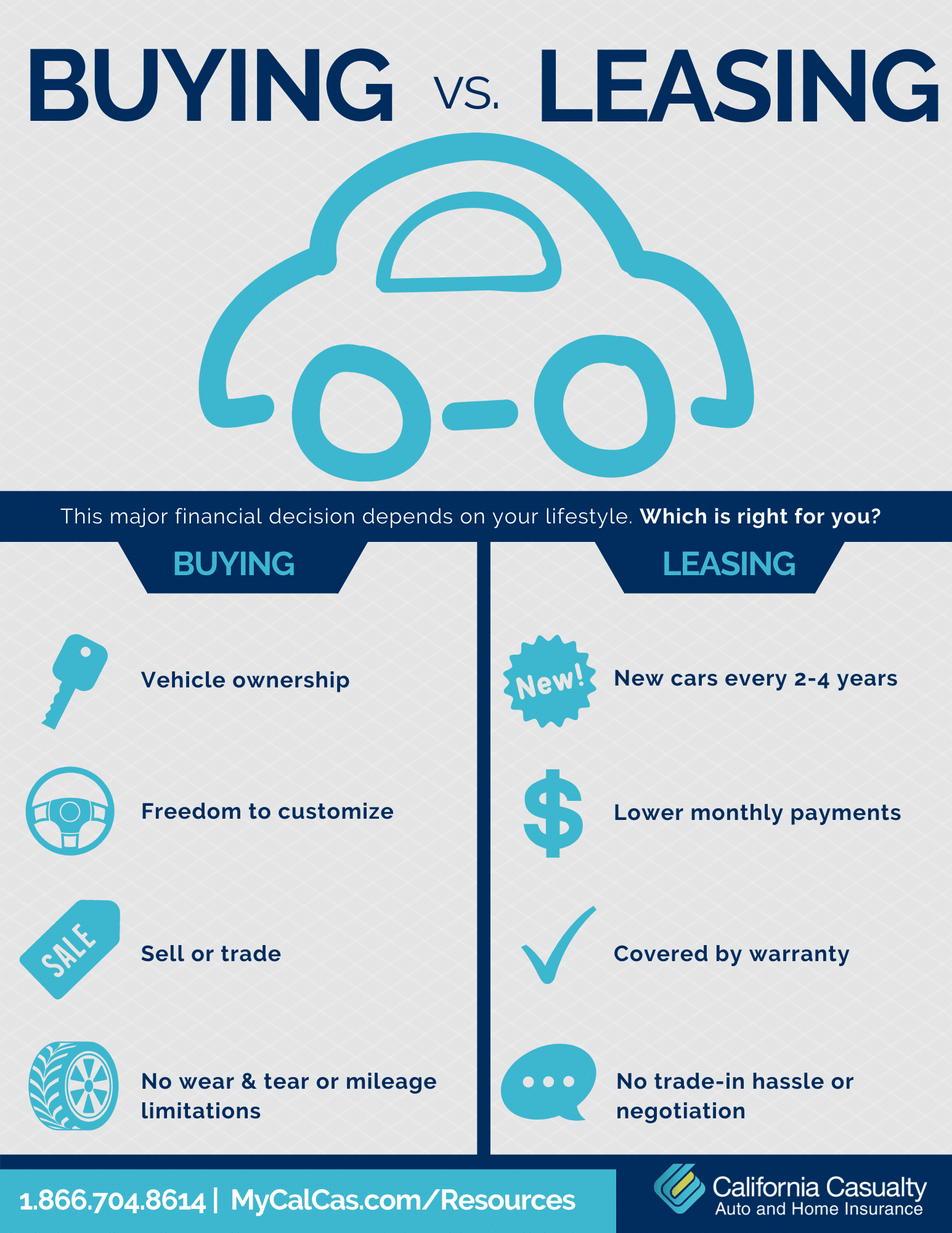

Buying vs. Leasing a Vehicle California Casualty

The calculator assumes equal wear and tear, registration fees, and fuel costs for both buying and leasing. High mileage on a leased car will lead to overage fees, but high mileage on an owned car will accelerate depreciation. Therefore, high mileage will affect both cars equally and for this reason is not considered in our calculations.

Pros and Cons of Leasing or Buying a Car

:max_bytes(150000):strip_icc()/when-leasing-car-better-buying.asp_final-10bbb582c2f74c2b9c4eafcc6fbab0bd.png)

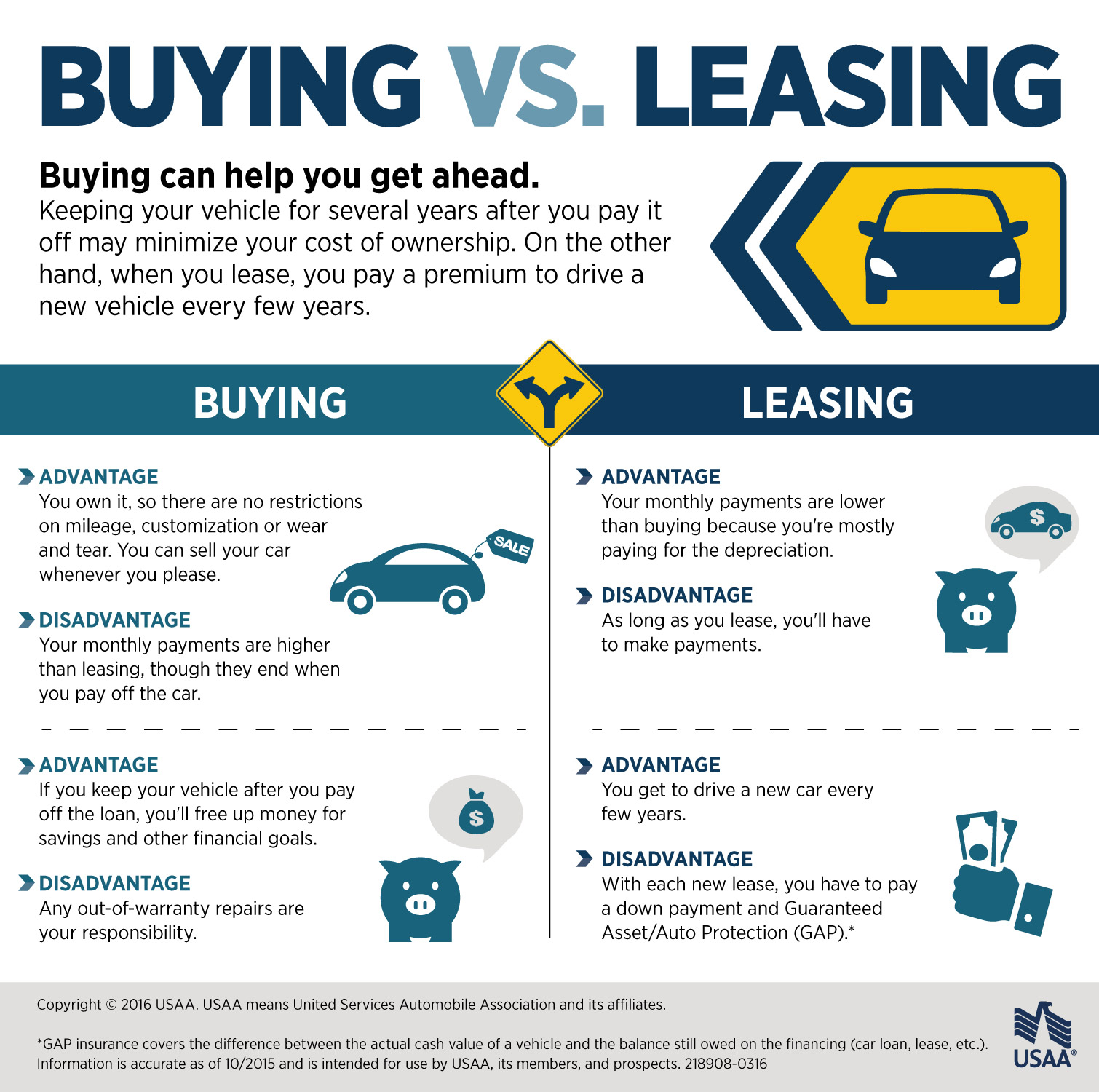

Calculating the total cost for a lease involves adding up all of the lease payments, any end-of-lease fees, and any initial pre-signing costs. Serial leasing means that you will always have a lease payment. The total cost of buying a car includes the down payment, taxes, all loan payments, and all out-of-pocket expenses for maintenance and.

Buying or Leasing a Car Which is the Better Financial Decision? — Seabright Financial

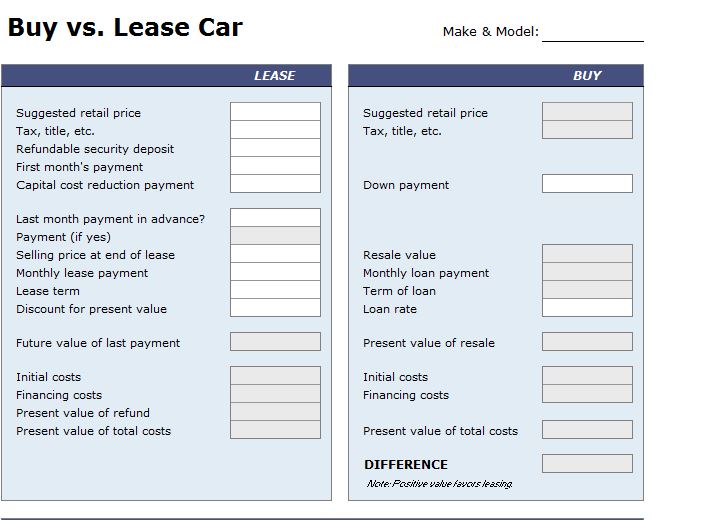

Simple input the correct values in the fields below and click on the "Calculate" button. The calculator will instantly generate a side-by-side view of the costs associated with leasing and buying. Please note: The calculation assumes that you will achieve the average market value when you sell your car at the end of the lease term.

Buy vs Lease Car Calculator Leasing vs Buying a Car Calculator

Both leasing and buying involve making monthly payments. Unlike leasing, when you buy a car you eventually own the vehicle. When you lease a car, you agree to an annual mileage limit with the dealer — typically 10,000, 12,000, or 15,000 miles (though some dealers have higher mileage options). You also agree to maintain the vehicle.

Buying Vs Leasing A New Car Retirement Budget Calculator

Leasing a vehicle is essentially renting a car for a set period of time. Buying a car means you own it outright after paying off your loan. To help decide which option may be best for you, our lease vs. buy car calculator can help you run the numbers and see which might make better financial sense for your situation.

Valley Chevy Buying vs Leasing a Car Infographic Valley Chevy

Leasing a car may be an attractive option if you prefer to drive a different model every few years. Plus, leasing a car typically means lower monthly payments. But the trade-off is that you end up paying for your vehicle year after year. On the other hand, buying a car generally means higher monthly payments, but those payments end once your.

Is it Better to Buy a Car or Lease a Car? Buying vs Leasing TIPS

Buy Car Calculator Terms & Definitions. Lease - An agreement whereby the party grants the use of property (in this case, a car) or services to another for a specific period time. Purchase Price - The total amount you pay for goods (in this case, a car) or services. Sales Tax Rate - A tax imposed by the government at the point of sale (in.

Should I Buy or Lease a Car? Pros & Cons of Leasing vs Buying Buying new car, Car purchase

Decision Calculator: Buy vs. Lease ;. Many people have trouble deciding whether to lease a new car or to buy it. This calculator will help them make the right decision based on their individual.

Buying vs. leasing a car what to keep in mind

If so, leasing makes sense, because usually you will put less money down than if you buy. In many cases, dealers will waive a down payment. You need only come up with $1,000 to $2,000 for fees.

Deciding Whether to Buy or Lease a Car

You want the $50,000 car and have negotiated the price down to $45,000. It will be worth $30,000 at the end of the lease, so your lease cost, before interest, taxes, and fees, will be $15,000 divided into equal monthly payments. If you put $2,000 down, the amount you make payments on drops to $13,000.

Choosing Your Next Commercial Car Buying Versus Leasing business recognition business

Our Auto Lease vs. Buy Calculator will help you make that decision. Car leasing means that you pay a monthly fee to rent a car for a set period of time, usually anywhere from 24 to 42 months, and with a set annual mileage limit, usually between 8,000 to 15,000 per year. After the lease is up, you return the car.

Buying vs Leasing a Car Infographic Plaza

Use this lease vs buy calculator to decide whether leasing or buying a car is best for you. Calculate the savings on your next car lease or new car purchase.

Leasing vs Buying a Car Infographic USAA

While they are trending lower, new-car prices still remain high (more than $47,400 in January 2024, according to Cox Automotive), which makes leasing a new vehicle an alternative.However.

Buy Droom

Loan Terms. Loan term. (months) The calculator above is designed to illustrate the differences in monthly payments between a lease versus a traditional auto loan. In this "lease versus buy.

Pin by Community Choice Credit Union on Car buying tips Car buying, Car buying tips, Lease

As of the first quarter of 2022, the average car lease payment was $522—$126 less than the average auto loan payment of $648 for a new car, according to Experian. In addition to monthly payments.